Get The Results You Need to Improve Your Credit

New Credit Life is an El Paso-based credit repair and consulting company focused on giving clients a new lease on their credit. Your credit score is an enormously important number, and it’s much easier to ruin that number than it is to keep it high and in good standing. As a result, millions of Americans have to deal with the problems of subpar credit.

- Free Consultation & Enrollment

- 100% Money Back Guarantee

- Free Credit Analysis Consultation

Testimonials

Trustindex verifies that the original source of the review is Google. These individuals did an incredible job; in just 30 days of working on my file, my credit score rose from 585 to 685. I’m truly impressed with their professionalism and the quality of their work. I’m so pleased that I’m recommending them to all my friends and family—it was definitely worth every cent. Thank you very much!Trustindex verifies that the original source of the review is Google. Excelente servicio me ayudaron demasiado 100% recomendadoTrustindex verifies that the original source of the review is Google. I had the pleasure of working with David. He is great ans really knows what he's doing. At first I was iffy about the process but he explained everything in depth and made me feel confident about everything. I saw a difference in 2 weeks. Great result!Trustindex verifies that the original source of the review is Google. David was always very honest on the pricessTrustindex verifies that the original source of the review is Google. This guy David KNOWS what he's talking about. I'm glad I was able to find this company. They got me educated, processed, set up, and moving FORWARD most importantly. If you are having issues with your credit THIS is the way with new credit life. I mean it's in the name. Thanks again for all the help.Trustindex verifies that the original source of the review is Google. Mr David assisted me with all my credit needs, he was very detailed throughout the whole process from the start to the end. He sets realistic deadlines unlike other providers I’ve used. Now, the results I got was literally work he did, all I did was just follow the instructions he gave. He did mention that the results do vary from customer to customer but he pretty much delivered in a short period of time. He got me from a low 600 to 730+ in a short period of time. I definitely recommend Mr David and New Credit Life to people who really need to work on their credit.Trustindex verifies that the original source of the review is Google. I recently used this service, and I couldn't be happier with the results! Within just 2 months, they were able to remove a delinquent account from my credit report after attempting it by myself for almost 2 years. The process was smooth and great communication. Highly recommend! 🌟🌟🌟🌟🌟Trustindex verifies that the original source of the review is Google. I’ve been working with David the last couple of months and the results have been impeccable; a complete turn around on my credit. He answers all my questions, and goes above and beyond to provide guidance to ensure results! His services are affordable. Highly recommend to anyone seeking credit repair!Trustindex verifies that the original source of the review is Google. All I can say is amazing! David helped me he was very punctual and helped me go from a 550 to a 680 in a matter of months which helped me close on a house!! They deleted pretty much everything off my credit! Would 10/10 recommend! Thank you New Credit Life!Trustindex verifies that the original source of the review is Google. David is very good on communication & gets more than the job done!! Best credit repair in EL PASO! He removed 18 negative items on my credit report & my score went from a 560 to a 710 (150+ points) in about 2 months! Not to mention he got hospital bills and a car repossession off my reports like nothing!! You won’t regret it! Very affordable too!

About us

New Credit Life is owned and operated by David Rosas, a certified credit repair and management consultant. Mr. Rosas began his credit journey by fixing his own credit score, and then by helping friends and family who need credit help. Eventually, Mr. Rosas decided to turn his knowledge of the credit system into a business designed to help as many people as possible. As such, New Credit Life was born!

How We Can Help Improve Your Credit Scores

We start our credit repair services by developing a credit action plan for clients, as well as by removing blights on credit that can wear the overall score down. Specifically, we can help by removing the following:

Collections Accounts

When an account is seriously past due, the creditor may decide to turn the account over to an internal collection department or sell the debt to a collection agency.

Repossessions

Repossession typically occurs after you fall behind on your auto loan payments and is a process where an auto lender can take back possession of your vehicle, sometimes without warning you in advance.

Charge-offs

A charge-off is an entry on your credit report that indicates a creditor, after trying and failing to get you to make good on a debt, has given up hope of getting payment and closed your account.

Bankruptcy

Bankruptcy is a legal process overseen by federal bankruptcy courts. It's designed to help individuals and businesses eliminate all or part of their debt or to help them repay a portion of what they owe.

Foreclosure

A foreclosure occurs when a mortgage lender takes possession of a property from a borrower after the borrower fails to keep up with their loan payments. Foreclosures typically occur only after you miss at least four successive monthly payments (120 days of delinquency)

Student Loans And More!

Our credit help services also deal with the following: Child Support, Medical Bills, Evictions, Hard Inquiries, Late Payments, Incorrect Personal Info.

Take Control of Your Credit With New Credit Life!

Your credit should be an asset, not an obstacle. At New Credit Life, we help clients get their credit under control and use their credit to make their dreams come true. Contact us today to schedule your free credit analysis and consultation!

Good Credit can Turn the Tables for Your Future!

Want to live a better life? Then you need to have a good credit score because that is going to affect your decision.

Buy Your home

Decide for your future and start investing in property. Choose the best for your family and get the best deal with the right credit score.

Get a New Car

Your stable and balanced credit score can help you buy your dream car. Let us help you with it and start living your dream with the right strategy.

Lower Interest Rates

You all know good credit scores can get you the best deals with the lowest interest rates that mean a bright credit future with better scores.

Quality for a better job

A good credit score and your balanced strategy for your account can also help you to find a good job you. Yes! You can try it and find the best for yourself.

Reach Financial Goal

Don’t compromise your life and dreams. Don’t set for low scores. Go high or go home. New credit life is all set to bring fulfill your financial goals.

Credit card approval

Agree or not but a good credit score will bring lots of ease in your life and approval of a credit card is one of those facilities you will enjoy it.

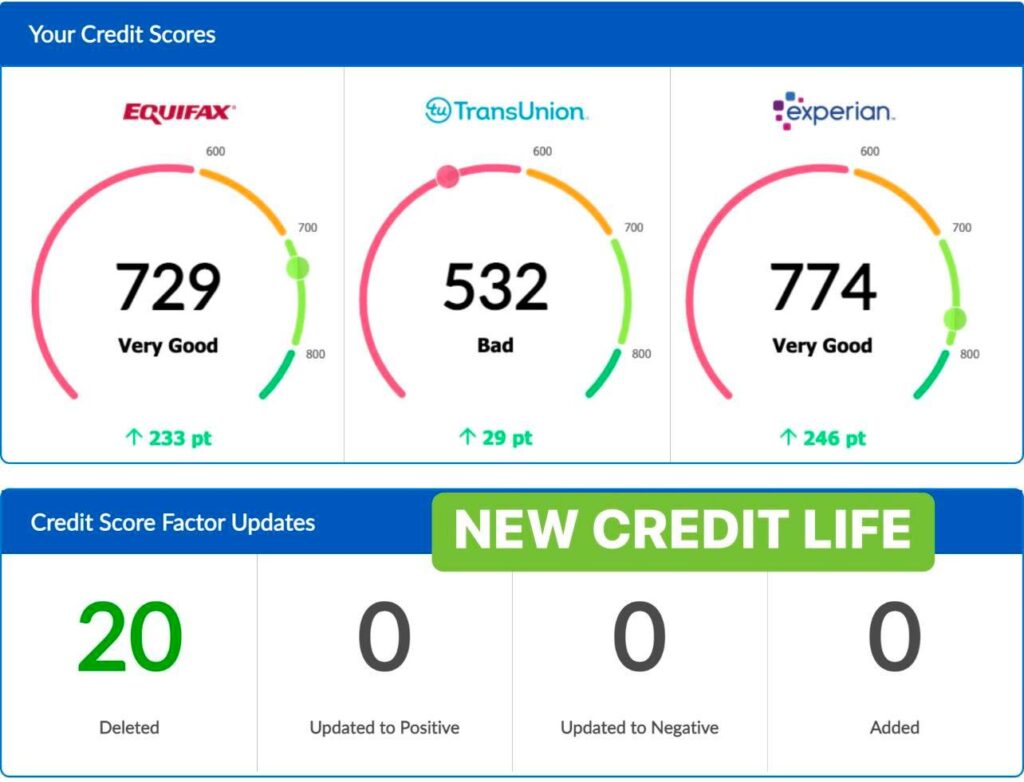

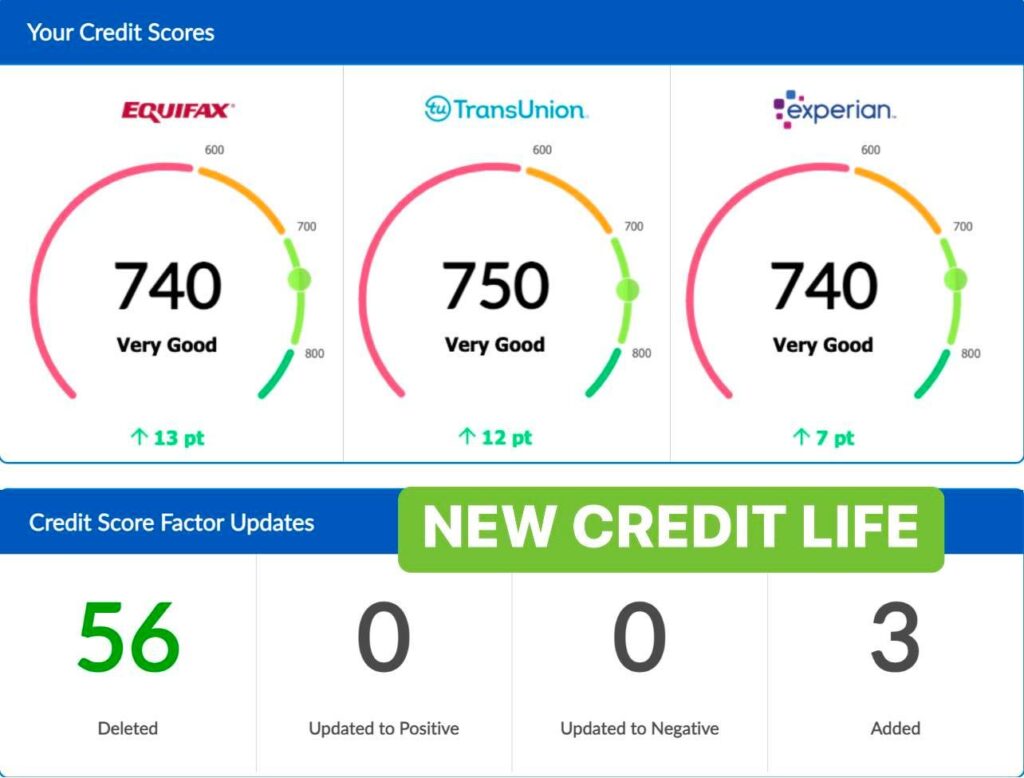

Pay Per Deletion Credit Repair

Most companies will prolong the process and charge you month after month with no results.

We offer Pay Per Deletion which means you only pay for negative items that are deleted off the credit report. If we are unsuccessful at removing negative items you do not pay us anything.

- Results Not Promises

- No Monthly Fees

Initial Audit Fee

Our Deletion Fees

-

Inquiry Removal- $10 (Per Item)

-

$25 For Late Payments (Per Bureau)

-

$50 For Collection Accounts (Per Bureau)

-

$50 For Charge Offs (Per Bureau)

-

$50 For Broken Leases (Per Bureau)

-

$75 For Repossessions (Per Bureau)

-

$75 For Public Records (Per Bureau)

Frequently Asked Questions (FAQ)

Q. What services do credit repair consultants in El Paso offer for those looking to purchase a home?

A. Credit repair consultants in El Paso typically offer services such as reviewing and analyzing credit reports, identifying negative items that can be disputed, providing personalized advice on improving credit scores, and assisting with the dispute process. This can help clients achieve a better credit profile, increasing their chances of being approved for a home loan.

Q. How does a credit audit work in the context of repairing ones credit in El Paso?

A. A credit audit involves a detailed examination of an individuals credit report from all three major credit bureaus. The consultant will look for inaccuracies, outdated information, or unverifiable entries that can be challenged or removed. The goal is to identify any errors that may be negatively affecting the clients credit score.

Q. Can a consultant guarantee the removal of negative items from my credit report when trying to improve my chances of purchasing a car in El Paso?

A. No legitimate consultant can guarantee the removal of negative items from your credit report. Credit repair companies must operate within the law; they can only help remove inaccuracies or contest questionable entries. Ultimately, it is up to the creditors and the credit bureaus to decide whether something will be removed.

Q. How long does it typically take to see results from working with a credit repair consultant in El Paso?

A. Results can vary depending on an individuals specific circumstances but generally speaking, some clients may start seeing improvements in their credit report within 30-60 days. However, more complex issues may take longer—sometimes six months or more—to reflect positively on one’s credit score.

Q. What should I consider before hiring a credit repair consultant in El Paso if I’m interested in puchasing a new home?

A. Before hiring a consultant, ensure they are reputable by checking reviews and testimonials. Understand what services are offered and at what cost; avoid companies promising unrealistic outcomes. Inquire about their experience with clients who have similar goals as yours (e.g., leasing property). Lastly, make sure youre comfortable with their approach and how they plan to assist you with your specific needs.

How New Credit Life Can Help

At New Credit Life, we understand that improving and maintaining your credit can come off as complex, but it doesn’t have to be that way. New Credit Life provides credit repair and management services to get your credit score up and keep it there. Contact us today to learn more about how we can help you!

Backed By The Best 100% Money Back Guarantee

You are entitled to a 100% refund on all payments if we do not remove any negative items we have worked on under the following circumstances:

- Money-Back Guarantee If No Deletions in 120 Days.

- You have not used a credit-consulting agency nor attempted to repair your credit three months previous to signing up for our services.

- You agree to send updated reports from the three credit bureaus to us within 5 days of receipt. (Clients should receive updated credit reports every 30-45 days. It is the client’s responsibility to make us aware if updated reports have not been received).